Carry Trade Still Popular, but Doubt is Growing

It’s safe to say that the inverse correlation observed between the Dollar (and also the Yen) and global equities is largely a product of the carry trade. “The U.S. stock market bottomed and the U.S. Dollar Index peaked almost simultaneously in March. While U.S. stocks are up more than 50% in that time, the Dollar Index (which measures the greenback’s value against the euro, the yen, the British pound, the Canadian dollar, the Swedish kroner and the Swiss franc) is down nearly 12%,” observed one analyst.

On one level, this represents a return to 2008, prior to the explosion of the credit crisis, when carry trading was THE dominant theme in forex markets. However, there is one important difference. While the Dollar and Yen were the funding currencies then and now (due to their low interest rates), there has been a slight shift in the currencies selected for the opposing/long end of the trade.

Traditionally, the most popular long currencies were those of industrialized countries, rich in commodities and backed by high interest rates and often rich in commodities. To be sure, these currencies have shined in recent months, certainly due in part to speculative (carry) trading. “Strategists at Wells Fargo Bank in New York ‘believe that the gains in the dollar-bloc currencies (Australia, New Zealand, Canada) have run ahead of the gains in commodity prices.’ ” The Bank of Canada also noticed that “At the time of its last statement, oil prices were about $75 a barrel, but now they are in the $60-to-$65 range. That suggests the currency’s appreciation has outpaced the demand for its commodity exports.”

But the run-ups in the Kiwi, Aussie, and Loonie have been overshadowed by even more rapid appreciation in emerging market currencies. This shift is largely a product of changes in interest rate differentials, which are now gapingly large between developed countries and developing countries. Compare the 2.75%+ spread between the US and Australia, with the 8.5% spread between the US and Brazil or 12.75% between the US and Russia. For investors once again becoming complacent about risk, the choice is a no-brainer.

Still, some analysts are nervous about this change in dynamic: “While the new carry trade may be less leveraged, it’s an inherently riskier bet. As such, it’s more vulnerable to the kind of swift unraveling of risk appetite observed across all nations and sectors in 2008, but which occurs with far more frequency in emerging markets.” Meanwhile, emerging market stocks have behaved volatilely over the last few weeks (with Chinese stocks even entering bear market territory), and some investors are concerned that they may be temporarily peaking. There are also signs that bubbles may be forming in carry trade currencies, with bullish sentiment at high levels. Accordingly, one strategist suggests waiting out a 5% pullback in the Australian dollar, and a 10% pullback in the New Zealand dollar before going back in.

There is also the outside possibility that the Fed will raise interest rates, which would crimp the viability of the US Dollar as a funding currency. Granted, it seems unlikely that the Fed will tighten within the next six months, but investors with a longer time horizon could begin to adjust their positions now, rather than wait until the 11th hour, at which point everyone will be rushing for the exits.

August 24th 2009

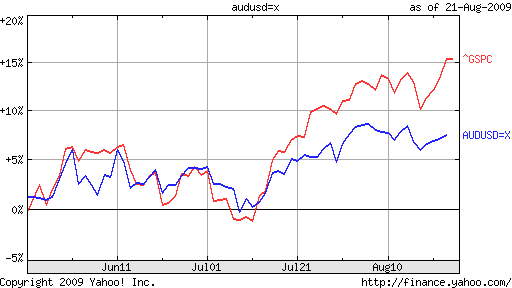

Australian Dollar Rises, Remains Closely Correlated with Stocks

The performance of the Australian Dollar over the last six months has been nothing short of incredible: “Since the end of February, the Australian dollar has risen 29% against the U.S. currency,” and a still-impressive 18% if you backtrack to January, when the Aussie was still in free-fall.

As has been the trend in forex markets of late, the currency’s rise cannot be attributed to an improvement in fundamentals. The economic picture remains nuanced (that is putting a positive spin on it), and definitive proof of recovery has yet to emerge. “We really are trawling pretty deep to try and get any snippet of information that might have some backhanded relevance as far as Australia goes,” said one analyst.

As a result, fundamental analysts have been forced to wait for a “more precise picture about the timing [of] any Reserve Bank of Australia interest rate hike.” On this front, investors are ratcheting down their expectations of a rate hike anytime soon, as “The RBA has signaled that there’s a danger of raising rates too soon.” Futures prices reflect the expectation that rates will rise by only 37 basis points from current levels before 2010, and by 161 basis points 12 months from now.

With such economic uncertainty, investors have turned their attention elsewhere. “Nomura Chief economist Stephen Roberts said in the absence of any clues about the fundamental drivers of the currency, nearly all the cues in foreign exchange markets are being taken from equities.” Some analysts have posited a close relationship with the US stock market: “The correlation between the Aussie dollar and U.S. equity market in particular has been very strong over the past few weeks, with our analysis showing a correlation as high as 95 percent.”

For other analysts, the relationship is with the Chinese stock market. This correlation makes more sense logically, since the Australian economic recovery is largely contingent on continued growth in China and the concomitant purchases of Australian commodities. “Currency markets will be watching the Shanghai share market, which has been a pretty big influence on the Aussie recently,” summarized one analyst. A reporter for the WSJ tried to spell it out even more clearly in an article entitled, “Australian Dollar Up Late, Closely Tied To Chinese Stocks.”

Unfortunately, the correlation with (Chinese) stocks runs both ways. When the Chinese stock market tanks - often for inexplicable reasons - as it has for the last three weeks, the Australian Dollar follows suit. Another analyst is more blunt: “The story for the Australian dollar and other risk- and growth-oriented currencies is similar to the share markets. They’ve had a great run and are probably due a bit of a pullback.”

August 22nd 2009

Dollar Reverts Back to Former Self

Only two weeks ago, analysts were singing about a new day for the Dollar, which had risen on the basis of good news for the first time in months. In hindsight, it looks like such talk was premature, as the Dollar has returned to its old ways. Good news once again causes the Greenback to fall, while bad news causes it to rise.

This development (or lack thereof) suggests that investors may have gotten ahead of themselves, when they sent the Dollar surging after the employment picture brightened slightly. At the time, the news was interpreted as a sign that rate hikes were imminent. On a broader level, it was a sign that investors had dumped the paradigm of risk aversion, in favor of a model based on comparing economic fundamentals. Since then, investors have slowly moved to distance themselves from the notion that the Fed will soon hike rates, and in the process have moved back towards trading based on risk dynamics.

As a result, positive news developments over the last couple weeks have coincided both with a rise in equity prices and a decline in the Dollar. When the Chinese stock market collapsed one day last week, investors responded by dumping high-yield assets, and moving temporarily back into “safe haven” currencies. “Diving Shanghai Helps Dollar” read one headline. “Worries over the continued fragility of the world economy outweighed a firmer tone in overseas equity markets to underpin the U.S. dollar versus major counterparts,” explained another report.

Meanwhile, a divide is forming among fundamental analysts. There is one school of thought which argues that the US will be the first industrialized economy to recover, and hence the first to raise rates. Based on this line of reasoning, then, positive economic news provides a foundation upon which to buy the Dollar. A competing school of thought, meanwhile, has suggested that regardless of if/when a US recovery materializes, it will be overshadowed by out-of-control inflation. In this regard, then, the Dollar is not such an attractive buy.

No less than the venerable Warren Buff has insisted that the Fed’s quantitative easing program and the US economic stimulus plan - while necessary - threaten to create even bigger problems than the ones they purport to solve. “But enormous dosages of monetary medicine continue to be administered and, before long, we will need to deal with their side effects. For now, most of those effects are invisible and could indeed remain latent for a long time. Still, their threat may be as ominous as that posed by the financial crisis itself,” he said.

If this true, then the Dollar is damned either way. Damned in the short-term as a result of a pickup in risk appetite, and damned in the long-term due to inflation.

Islamabad Time

Islamabad Time

0 comments:

Post a Comment